Newswire

PR Newswire - SMMT - Vehicle production dips amid EV transformation and intense market pressure

- British vehicle production slips -11.8% to 905,233 units in 2024, with cars down to 779,584, as industry continues transformation to EV production.

- 4.0% growth in commercial vehicle production fails to offset -13.9% decline in car output.

- Potential to surpass one million cars and light vans in 2028 if markets improve and model launches stay on track.

- Sector calls for government to fast track industrial and trade strategies for automotive manufacturing.

LONDON, Jan. 30, 2025 /PRNewswire/ -- UK vehicle production dipped below one million units in 2024, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). Factories turned out 779,584 cars and 125,649 commercial vehicles (CVs), a total of 905,233 units and -11.8% lower than in 2023. While CV output grew by 4.0%, its best level since 2008, multiple factors impacted car volumes, with the end of production for some long running models as factories retooled for EVs, weakness in key global markets, and a slowdown in the transition to electrification amid tough economic conditions.

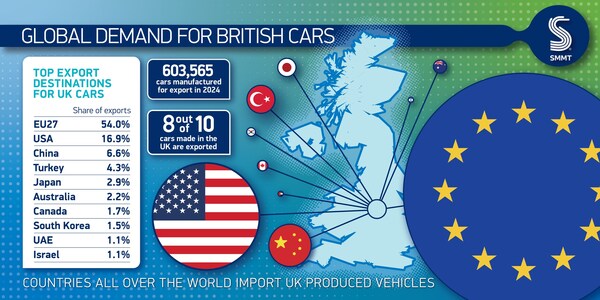

Top UK Car Exports 2024

Following a slew of restructuring announcements across the UK and Europe, reflecting the challenges of moving from ICE to EV production, December rounded off 10 consecutive months of decline for British car production, with output down -27.1% to 45,022 units. Over the year, car production fell -13.9%, with output for the UK market down by -8.0% to 176,019 units, while exports declined -15.5% to 603,565 units.

Nearly eight-in-10 cars produced were destined for export last year, with 77.5% (467,937 units) shipped to the top three markets: the EU (54.0%), US (16.9%) and China (6.6%). Exports to the EU and China were down -24.3% and -21.8% respectively, but those to the US rose 38.5%, emphasising the need for supportive trading conditions across the Atlantic. Turkey and Japan rounded off the UK's top five global export markets, followed by Australia, Canada, South Korea, UAE and Israel.

Given the wholesale transformation underway at many car factories, a decline in battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) vehicle output was expected. Volumes of these electrified technologies fell to 275,896 units, down -20.4% on the year before but still accounted for 35.4% of overall output and the second highest on record. With more than £20 billion worth of investment announced in 2023 and a further £3.5 billion in 2024 to drive the UK's transition to EV production, the decline will be temporary.1

Mike Hawes, SMMT Chief Executive, said, "Amid significant geopolitical and trade tensions, UK manufacturers are set on turning billions of pounds of investment into production reality, transforming factories to make new electric vehicles for sale around the world. Growing pains are inevitable, so the drop in volumes last year is not surprising. With new, exciting models and battery production on the horizon, the potential for growth is clear. Securing this future, however, requires industrial and trade strategies that deliver the competitive conditions essential for growth amidst an increasingly protectionist global environment."

The latest independent production outlook expects UK car and light van production to be around 839,000 units in 2025 before rising to 930,000 units in 2027, with the potential to get above one million units in 2028, and over 1.1 million by 2030.2 This is, however, dependent on global car and van market demand improving, positive economic conditions and greater consumer confidence, and the delivery of the competitive conditions necessary to ensure zero emission model launches stay on track.

Realising this ambition and unlocking future growth will require an industrial strategy with advanced automotive manufacturing at its heart, enabling innovation, attracting investment and supporting the country's highly skilled workforce. Equally important is a healthy domestic market, given manufacturers build close to where they sell, as well as strong overseas demand, notably for electrified vehicles which the sector, and government, has committed billions to making.

The industry, therefore, needs market regulation that reflects the reality of natural demand and a fiscal framework that incentivises consumers to buy these new vehicles that are fundamental to the achievement of our shared net zero ambitions. This must be aligned with an ambitious trade strategy that maintains a tariff-free enhanced trade partnership with the EU, and balanced, commercially meaningful trade agreements and critical minerals agreements with existing and new trading partners.

The right strategies will help secure the sector's position as a £100 billion global trade hub, with the potential to deliver £50 billion in UK growth over the coming decade, supporting government's economic, societal and environmental ambitions.3

Notes to editors

1: SMMT calculations based on publicly announced investment commitments, public and private, in UK automotive production and R&D in 2024.

2: Based on independent production outlook produced by AutoAnalysis in November – cars and light vans only.

3: SMMT Trade Snapshot 2024 and SMMT Vision 2035.

About SMMT and the UK automotive industry

The Society of Motor Manufacturers and Traders (SMMT) is one of the largest and most influential trade associations, representing the automotive industry in the UK. The automotive industry is a vital part of the UK economy, integral to growth, the delivery of net zero and the UK as a global trade hub. It contributes £93 billion turnover and £22 billion value added to the UK economy, and invests around £4 billion each year in R&D. With 198,000 people employed directly in manufacturing and some 813,000 across the wider automotive industry.

The UK manufactures almost every type of vehicle, from cars, to vans, taxis, trucks, buses and coaches, as well as specialist and off-highway vehicles, supported by more than 2,500 component providers and some of the world's most skilled engineers. In addition, the sector has vibrant aftermarket and remanufacturing industries. The automotive industry also supports jobs in other key sectors – including advertising, chemicals, finance, logistics and steel.

SMMT's Motor Industry Facts publication www.smmt.co.uk/reports/smmt-motor-industry-facts/

UK VEHICLE MANUFACTURING (data for December and FY 2024)

Hi-res charts available via Dropbox: https://www.dropbox.com/scl/fo/a1iat513l4t5r3rkdb57o/AJw7kC6rKE9DvMm6-E_Amlo?rlkey=cy9q0ydz6sbov67itj36ki4v0&st=adloem9m&dl=0

Latest Posts

โพสต์ล่าสุด

ภาษาไทย

ภาษาไทย English

English

Comment